Bad Credit Loans V.S. Fast 5k Loans – [2019 Review & Update]

Acquiring a loan online shouldn’t be as difficult as it tends to be.

Many of us make financial mistakes early on that tend to haunt us later on, I myself can speak truth into this matter.

Low credit scores not only nag at the back of your mind but more importantly is a tool used by financial institutions and businesses on a daily basis to determine whether you’ve been responsible with your finances previously.

Consider your credit score as your credentials on a resume in regards to securing a loan.

If you have a high credit score and meet other requirements then chances are you’ll have no problem securing a loan at competitive rates.

However, if you’re like most people then chances are your credit score is in the so-so or not-so-good range – which is absolutely okay.

With this in mind we’re going to provide you with a concise comparison review regarding 2 of the most widely-used loan matching networks as of 2019.

So let’s begin.

What are Loan Matching Networks?

Loan matching networks tend to be online platforms that provide prospective loan applicants the ability to apply for loans with a multitude of online lenders.

There are 3 main advantages you should concern yourself when dealing with loan matching networks which are as followed:

- More loan diversity

- More competitive loan rates

- Ability to conduct business with lenders you may not have been previously been familiar with

Fortunately for us, both Bad Credit Loans and Fast 5K Loans are both loan matching networks overseen by corporate entities.

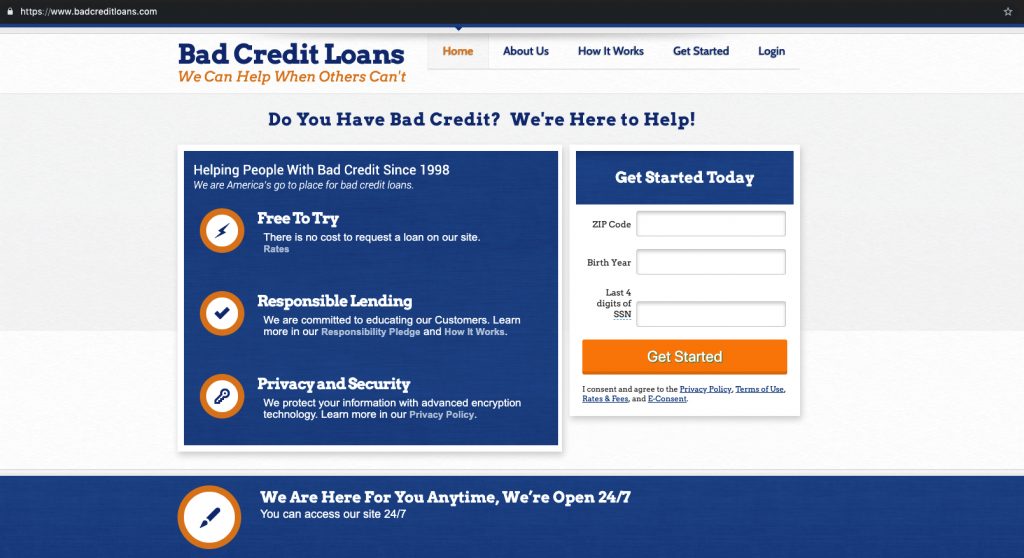

About Bad Credit Loans

Bad Credit Loans probably reigns supreme amongst loan matching networks that specializes in aiding consumers with low credit scores acquire a quick loan online.

Providing their lending services for a duration exceeding 20 years it is difficult for any entity to dispute the transparency and track record reflected by Bad Credit Loans.

Loans up to $5,000 are provided and are said to take between 24 to 72 hours to be received via direct deposit.

Repayment periods tend to range between a 3 to 36 month period while APRs fluctuate between 5.99% to 35.99% for most loan applicants.

Eligibility Requirements

- 18 years of age or older

- Must earn more than $1,000 per month

- Must reflect legal status or show proof of citizenship

- You may be required to disclose proof of employment over past 3 months

- Provide an accurate phone and email address

- Possess a checking account (loan delivery method is direct deposit, if approved)

Type of loans offered would be personal, home, auto, student and business loans.

Best of all, Bad Credit Score does not enforce a minimum credit score requirement.

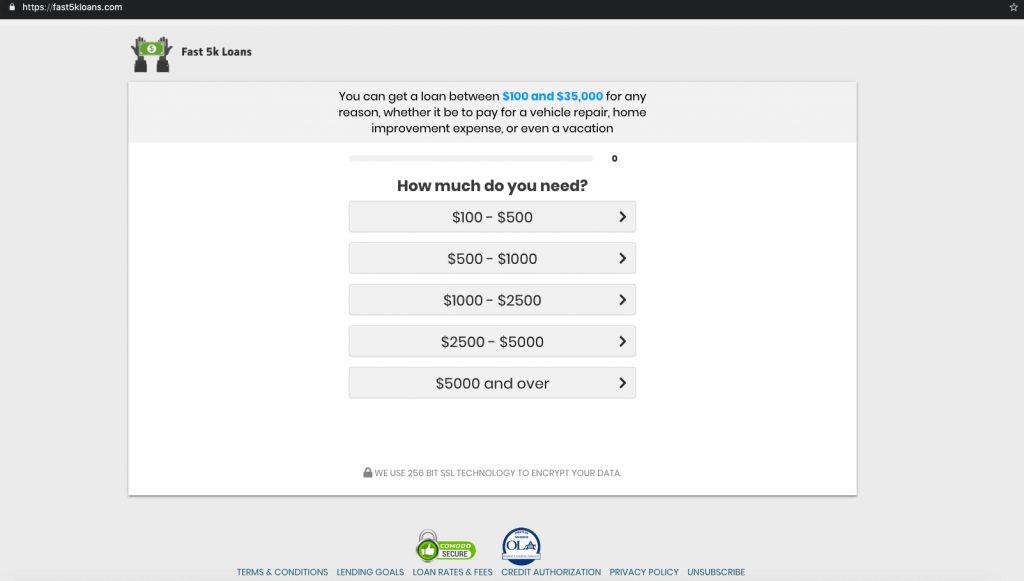

About Fast 5K Loans

Fast 5K Loans is widely considered as a one-stop-destination for acquiring more hefty loans.

Available only to U.S. citizens, Fast 5K Loans provides short-term loans between $500 to $35,000.

Incepted in 2015, Fast5KLoans.com appears to be steadily growing in popularity and supported an incoming visitor total of over 2.17 million in April 2019 according to SimilarWeb.

Loan repayment periods range between 1 month to 2 years while the designated agent office is headquartered out of New Jersey.

Annual Percentage Rates (APRs) are a bit on the wild side with Fast 5K Loans and have been reported to float around 200% to 1,300%.

Eligibility Requirements

- Must be a U.S. citizen

- Must be 18 years of age or older

- Must be actively employed or receive steady income

- Must possess a valid bank account to receive loan funds, if approved

As a whole, Fast 5K Loans can be considered more along the lines of a payday loan matching network.

Comparison Scope

To provide a more thorough oversight into both of these loan matching networks we have compiled a 5 point comparison scope.

Transparency

- Bad Credit Loans states that they are owned an operated by Chief L.L.C.

- Fast 5K Loans is overseen by DV Marketing, Inc.

Unlike many loan matching networks currently in existence, both Bad Credit Loans and Fast 5K Loans provide ownership information.

Longevity

- Fast 5K Loans was incepted on November 11th, 2015.

- Bad Credit Loans has been in business since January 1st, 1998 (21+ years).

There is a considerable track-record gap between Fast5K Loans and BadCreditLoans.

Loan Rates

- Bad Credit Loans annual percentage rates range between 5.99% to 35.99%.

- Fast 5K Loans APRs are astronomical and reside between 200% to 1,300% on average.

While Fast5K Loans may possess more slacked eligibility requirements, Bad Credit Loans clearly offers loan applicants a better bang for their buck in regards to fair, competitive loan rates.

Popularity

- According to SimilarWeb, BadCreditLoans.com reflected a global rank of 97,373 with a US rank of 19,799 as of May 24th, 2019.

- According to SimilarWeb, Fast5KLoans.com reflected a global rank of 31,247 and a US rank of 5,451 as of May 24th, 2019.

While Bad Credit Loans may have been in business for 5x’s the length as Fast5KLoans.com has been, Fast 5K Loans appears to receive more traffic and is more reputable on the net.

Ease of Use

- Bad Credit Loans provides a simplistic application and approval verdict within a couple minutes of completing their application process (which is said to take no longer than a few minutes to complete).

- Similarly, Fast5K Loans provides an application process that takes a handful of minutes to complete while approval verdicts can take upwards to 5 minutes.

Both loan matching networks provide easy to use application processes which is perhaps why both of these loan matching networks are highly reputable.

Advantages of Bad Credit Loans

- Reflects over 21 years of business

- APRs are competitively ranged between 5.99% to 35.99%

- Provides a multitude of loan options for prospective borrowers

- Widely considered the best place to acquire a competitive online loan

- Application process takes no longer than 5 minutes to complete on average

- Bad Credit Loans does not enforce a minimum credit score requirement

- Bad Credit Loans is a loan matching network which means you may be matched with multiple lenders which may result in more competitive loan rates for you

- Repayment periods up to 3 years are offered

- BadCreditLoans.com is FREE to use

- Bad Credit Loans is specialized for consumers that reflect poor to ‘unsatisfactory’ credit history

Disadvantages of Bad Credit Loans

- Minimum loan request must be atleast $500

- Bad Credit Loans could be more forward about which lenders are part of their network

- Some consumer reports can be found saying that they were approved only to later find out that their application was actually denied

Pros of Fast 5K Loans

- Appears rather reputable across the web

- Provides personal loans up to $35,000

- Eligibility requirements can be considered bare-bone

- Over the past 3 months Fast 5K Loans as doubled their incoming visitor traffic total

- Available to US consumers despite credit history

- Reflects over a few years of active business

- Minimum loan amount of $100 is offered

- Fast5KLoans.com is FREE to use

Cons of Fast 5K Loans

- Requires STEEP APRs between 200% to 1,300%

- Can be classified as a payday loan matching network

- Repayment periods are a bit of the fast side and range from 1 to 24 months

- Fast5KLoans.com fails to disclose their network of approved online lenders

Official Site: Fast5KLoans.com

Which Lending Network is More Consumer Friendly?

Depends upon how you look at it.

Fast 5K Loans certainly provides consumers with the ability to acquire more cash but also is accompanied with loan rates that are not only outrageous but can hardly be deemed ‘ethical.’

On the other hand, Bad Credit Loans provides much more competitive loan rates but consumers are also limited by being able to apply for loans only up to $5,000.

If we were to take the points highlighted through our comparison scope and combine it with the pros and cons of both loan matching networks, we’d have to say Bad Credit Loans is more consumer friendly.

Bad Credit Loans & Fast 5K Loans Review

Both Bad Credit Loans and Fast 5K Loans have their advantages and disadvantages.

The aim of this unbiased review was to provide you with the necessary insight that you needed to know regarding how both successful loan matching networks are operating as of 2019.

For consumers seeking more bulky loans then perhaps Fast 5K Loans is best for you although we don’t necessarily advice consumers to rely upon loan matching networks that can essentially be deemed as ‘payday lenders.’

From a trustability standpoint, we believe Bad Credit Loans is a more appropriate option given their 21+ years in business and overall community standing.